The seasonally adjusted current account of the euro area recorded a deficit of EUR 11.2 billion in November 2010. This reflected deficits in current transfers (EUR 6.5 billion), income (EUR 4.3 billion) and goods (EUR 4.0 billion), which were partly offset by a surplus in services (EUR 3.5 billion).

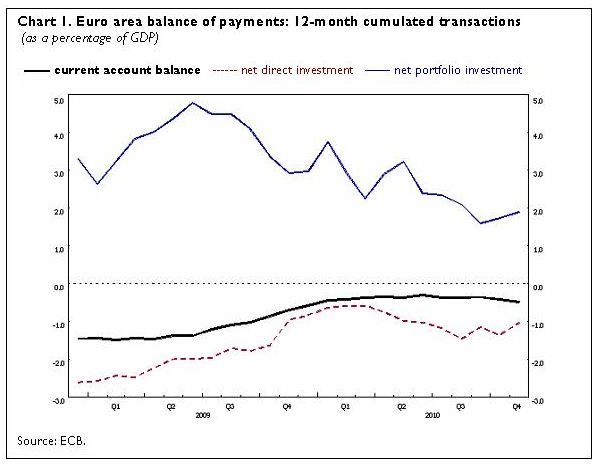

The 12-month cumulated seasonally adjusted current account recorded a deficit of EUR 44.4 billion in November 2010 (around 0.5% of euro area GDP), compared with a deficit of EUR 62.4 billion a year earlier. The reduction of the current account deficit was accounted for by a decrease in the deficit in income (from EUR 30.3 billion to EUR 8.1 billion) and an increase in the surplus in services (from EUR 31.6 billion to EUR 37.6 billion), which were to a limited extent counterbalanced by a decline in the surplus in goods (from EUR 30.8 billion to EUR 25.4 billion) and a rise in the deficit in current transfers (from EUR 94.6 billion to EUR 99.3 billion).

In the financial account, combined direct and portfolio investment recorded net inflows in November 2010 (EUR 38 billion), which were accounted for by net inflows both in direct investment (EUR 25 billion) and in portfolio investment (EUR 13 billion).

The net inflows in direct investment resulted from net inflows both in equity capital and reinvested earnings (EUR 10 billion) and in other capital (mostly inter-company loans) (EUR 15 billion).

The net inflows in portfolio investment were mainly accounted for by net inflows in debt instruments (EUR 26 billion), which were partly offset by net outflows in equity (EUR 13 billion). The net inflows in debt instruments resulted both from net purchases of euro area securities by non-residents and from net sales of foreign securities by euro area residents.

Financial derivatives recorded net inflows of EUR 1 billion.

The other investment account recorded net outflows (EUR 24 billion) reflecting net outflows in MFIs (excluding the Eurosystem) and other sectors (EUR 20 billion in both cases), which were partly offset by net inflows in general government (EUR 11 billion) and the Eurosystem (EUR 5 billion).

The Eurosystem’s stock of reserve assets increased from EUR 556 billion to EUR 597 billion in November 2010, mainly on account of valuation effects (transactions were balanced in November 2010).

In the 12-month period to November 2010, combined direct and portfolio investment recorded cumulated net inflows of EUR 78 billion, compared with net inflows of EUR 175 billion a year earlier. This decrease was the result of lower net inflows in portfolio investment (down from EUR 261 billion to EUR 172 billion) and higher net outflows in direct investment (up from EUR 86 billion to EUR 94 billion).

International investment position at the end of the third quarter of 2010

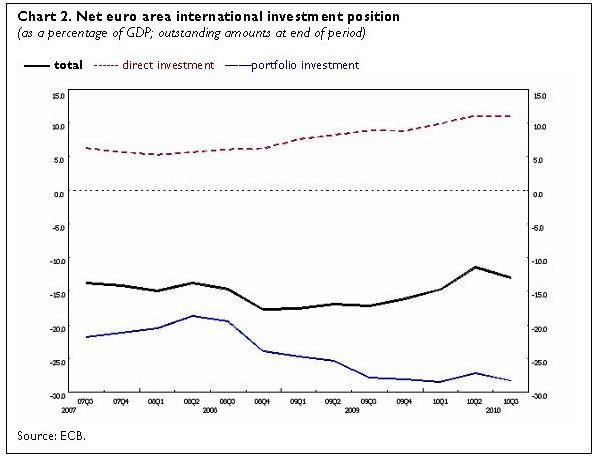

At the end of the third quarter of 2010, the international investment position of the euro area recorded net liabilities of EUR 1.2 trillion vis-à-vis the rest of the world (about 13% of euro area GDP). This represented a rise of EUR 147 billion in comparison with the revised data at the end of the second quarter of 2010.

The change in the net international investment position was mainly due to a higher net liability position in portfolio investment (from EUR 2 462 billion to EUR 2 579 billion) and, to a lesser extent, to a lower position in reserve assets (down from EUR 583 billion to EUR 552 billion). The changes in the net positions were primarily driven by “other changes” (predominantly revaluations on account of exchange rate and asset price changes).

At the end of the third quarter of 2010, the gross external debt of the euro area amounted to EUR 11.0 trillion (about 121% of euro area GDP), which represented a decline of EUR 174 billion in relation to the revised data at the end of the previous quarter.

Data revisions

This press release incorporates revisions to the balance of payments for the period from April 2010 to October 2010, and to the international investment position at the end of the second quarter of 2010.

The revisions to the balance of payments in October 2010 did not significantly change the previously published data for the current and capital accounts. The financial account was mainly revised on account of revisions to net inflows in portfolio investment (up from EUR 14 billion to EUR 21 billion).

The current account deficit in the second and third quarters of 2010 was revised downwards (from EUR 23.1 billion to EUR 20.4 billion, and from EUR 15.7 billion to EUR 8.3 billion), mainly on account of revisions to income. In the financial account, revisions mainly affected other investment in the second quarter of 2010, and direct investment and portfolio investment in the third quarter of 2010. The revisions to the international investment position at the end of the second quarter of 2010 led to lower net liability positions in portfolio investment and in other investment.