French Emerge as Most Avid Mobile Bankers

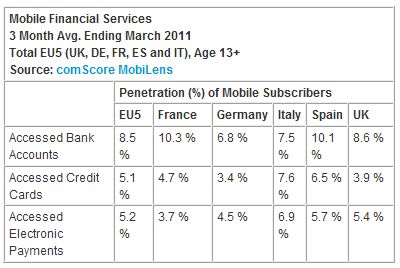

During the 3 month period ending March 2011, France boasted the highest penetration of mobile bankers in EU5 with 10.3 percent of consumers accessing bank accounts through their mobile phones. Spain ranked a close second with 10.2 percent penetration. Germany, which is the largest smartphone market in Europe, had the lowest penetration of mobile banking users with 6.8 percent accessing their bank accounts. In the EU5 region, 8.5 percent of mobile subscribers overall accessed mobile banking, whilst 5.1 percent accessed credit cards and 5.2 percent accessed electronic payments via their mobile device.

UK mobile phone owners were the most conservative with regards to accessing credit card accounts and only 3.9 percent of the mobile population used the service in March 2011. On the other hand, mobile banking reached 8.6 percent of the total UK mobile market, making it the third largest market for mobile banking in Europe.

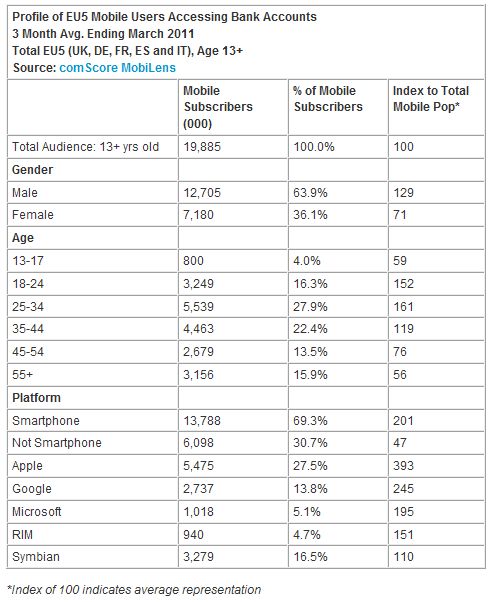

Males Twice as Likely as Females to Use Mobile Banking

In the EU5 countries, nearly two males accessed mobile banking for every one female. Among age segments, 25-34 year olds accounted for the highest percentage of mobile banking users (27.9 percent), and were also the highest indexing segment (index of 161). Mobile users aged 55 and older showed the lowest relative usage of mobile banking with an index of 56.

Perhaps not surprisingly, smartphone users accounted for nearly 70 percent of mobile banking users, despite accounting for just 35 percent of the total mobile population. Apple users exhibited the highest relative usage of mobile banking (index of 393), followed by users of Google Android (index of 245).

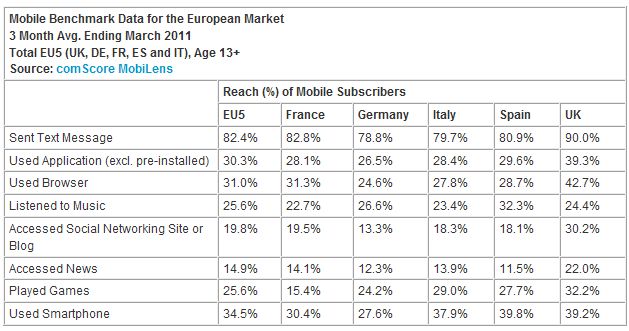

March 2011 European Mobile Benchmark Data

The table below shows comScore’s March 2011 benchmark data, including a review of mobile consumption behaviors and device penetration for the five EU countries under measurement. These benchmark data are published by comScore to provide the most up-to-date snapshot of the mobile industry. Further information on these benchmark data, and other data included above, can be provided upon request.