The total number of non-cash payments in the EU, using all types of instruments, increased by 4.4% to 86.4 billion in 2010 compared with the previous year. Card payments accounted for 39% of all transactions, while credit transfers accounted for 28% and direct debits for 25%.

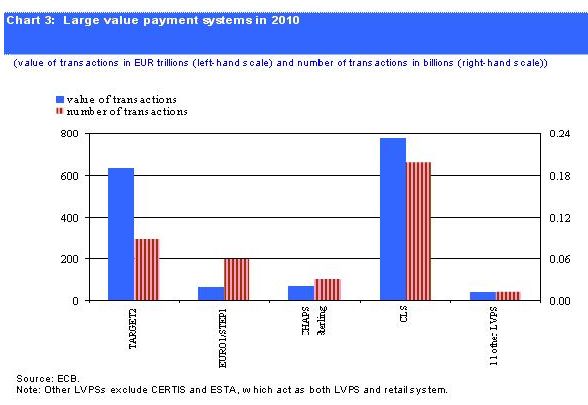

The number of credit transfers within the EU increased in 2010 by 3.8% to 24.0 billion. The importance of paper-based transactions continued to decrease, with the ratio of paper-based transactions to non-paper-based transactions falling to around one to five. The number of cards with a payment function in the EU remained relatively stable at 726.7 million compared with 725.2 million in 2009. This represented around 1.45 payment cards per EU inhabitant. The number of card transactions rose by 6.7% to 33.9 billion, with a total value of € 1.8 trillion. This corresponds to an average value of around € 52 per card transaction. Chart 1 below shows the use of the main payment instruments from 2000 to 2010.

The relative importance of each of the main payment instruments varied across EU countries in 2010. The biggest difference was observed for credit transfers, the usage of which ranged from 10% in Luxembourg to 72% in Bulgaria.

In 2010, the total number of Automatic Teller Machines (ATM) in the EU decreased slightly by 0.2% to 434.2 thousand, while the number of Points of Sale (POS) terminals increased by 3.0% to 8.8 million.

Retail payment systems

Retail payment systems in the EU handle mainly payments that are made by the public, with a relatively low value and no time-criticality.

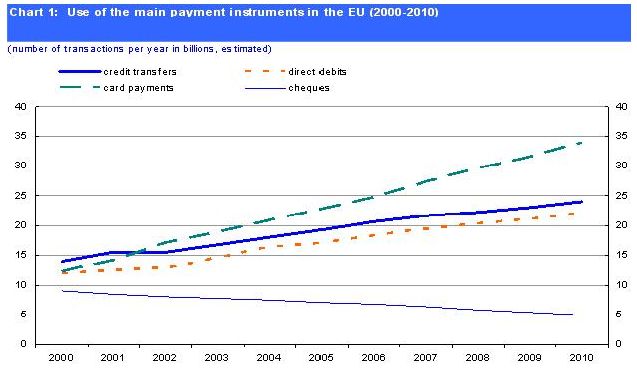

In 2010, 39 retail payment systems existed within the EU as a whole, serving a total population of approximately 500 million. During the year, 39.3 billion transactions were processed by those systems in an amount of € 27.8 trillion. 19 of these systems were located in the euro area, where they served a total population of 330 million. The euro area systems processed 27.8 billion transactions in 2010 (i.e. 71% of the EU total) with a value amounting to € 17.8 trillion (i.e. 64% of the EU total).

There was a notable degree of concentration in EU retail payment systems in 2010. The four largest systems (SIT/CORE in France, BACS in the United Kingdom, Equens in the Netherlands and Germany, and RPS in Germany) processed 64% of the volume and 54% of the value of all transactions processed by EU retail payment systems. Chart 2 shows the number and value of transactions processed by EU retail payment systems in 2010.

Large-value payment systems

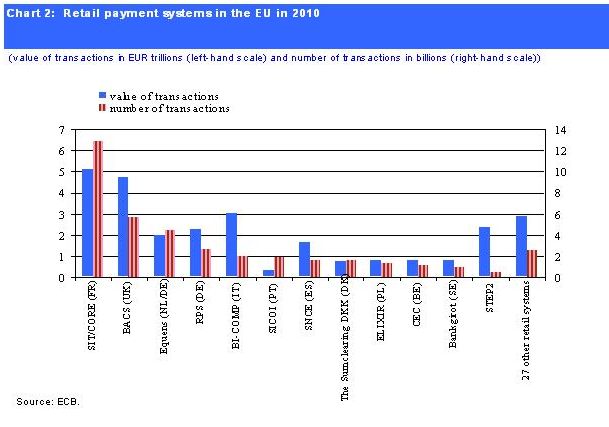

Large-value payment systems (LVPSs) are designed primarily to process urgent or large-value interbank payments, but some of them also settle a large number of retail payments. During 2010, 16 LVPSs settled 684 million payments with a total value of € 810 trillion in the EU. The two main LVPSs in the euro area (TARGET2 and EURO1/STEP1)settled 147 million transactions amounting to € 696 trillion in 2010, i.e. 86% of the total value. In the non-euro area EU countries, CHAPS Sterling in the United Kingdom is the largest LVPS in terms of value and number of transactions.

Outside the EU, CLS is the most important large value payment system processing inter alia euro and other EU currencies. CLS (all currencies) settled 198 million transactions with a value of € 774 trillion in 2010. Chart 3 below shows the number and value of transactions processed by LVPSs in 2010.